How Feie Calculator can Save You Time, Stress, and Money.

Wiki Article

Some Known Facts About Feie Calculator.

Table of ContentsThe Main Principles Of Feie Calculator Facts About Feie Calculator UncoveredFascination About Feie CalculatorSome Known Incorrect Statements About Feie Calculator Some Known Incorrect Statements About Feie Calculator

First, he marketed his united state home to develop his intent to live abroad completely and looked for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Examination. Furthermore, Neil protected a long-lasting residential or commercial property lease in Mexico, with plans to eventually purchase a building. "I presently have a six-month lease on a house in Mexico that I can prolong another 6 months, with the purpose to acquire a home down there." However, Neil aims out that acquiring residential or commercial property abroad can be challenging without first experiencing the location."It's something that people require to be actually attentive concerning," he states, and advises deportees to be mindful of typical mistakes, such as overstaying in the United state

Neil is careful to mindful to Anxiety tax authorities that "I'm not conducting any performing any type of Company. The U.S. is one of the couple of nations that tax obligations its people no matter of where they live, indicating that also if an expat has no revenue from U.S.

tax returnTax obligation "The Foreign Tax Debt enables people working in high-tax nations like the UK to offset their U.S. tax obligation obligation by the quantity they have actually already paid in tax obligations abroad," states Lewis.

The Of Feie Calculator

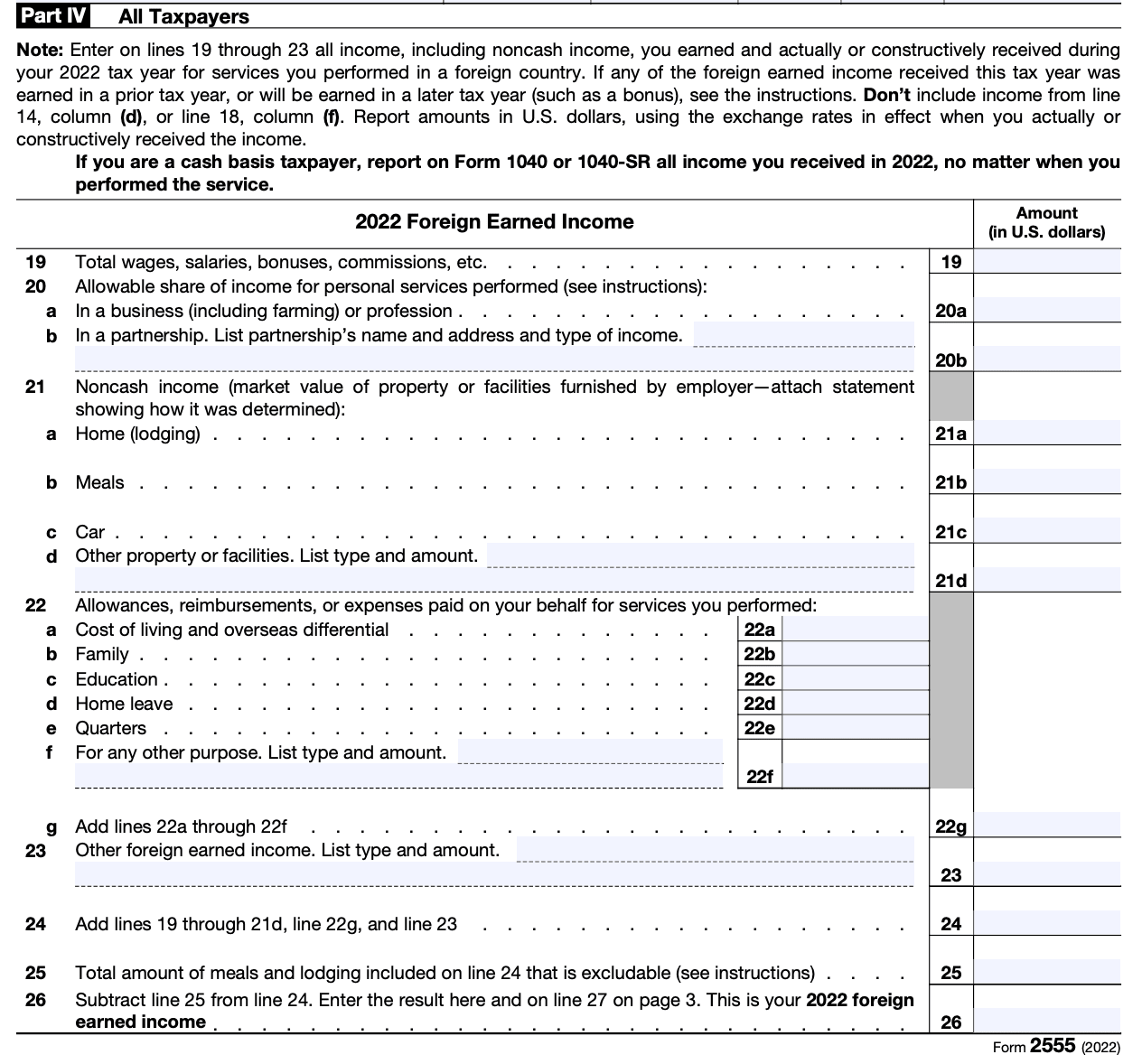

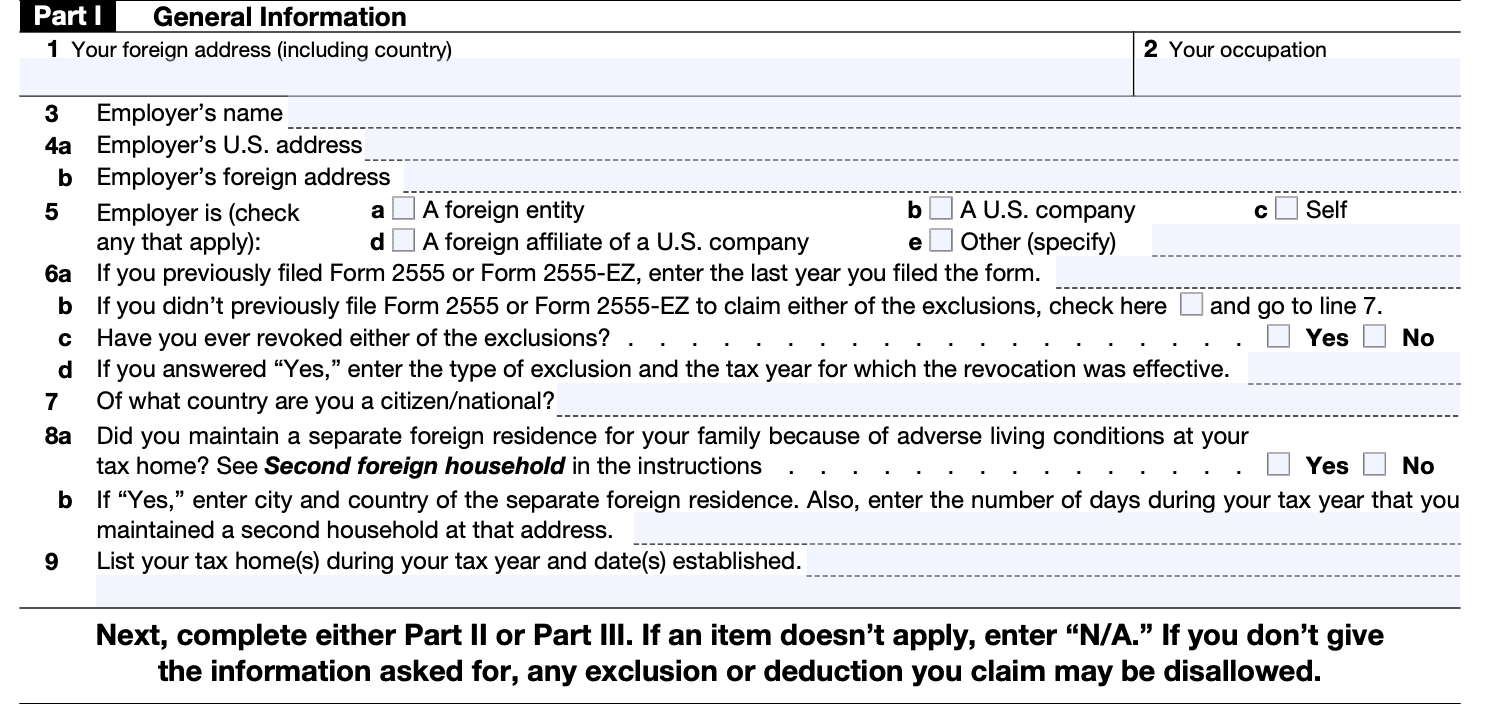

Below are a few of one of the most frequently asked concerns concerning the FEIE and other exemptions The Foreign Earned Revenue Exclusion (FEIE) allows U.S. taxpayers to exclude approximately $130,000 of foreign-earned income from federal revenue tax obligation, decreasing their U.S. tax responsibility. To receive FEIE, you should meet either the Physical Presence Test (330 days abroad) or the Authentic House Test (prove your key house in an international nation for an entire tax obligation year).

The Physical Existence Test needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Test likewise needs united state taxpayers to have both a foreign revenue and a foreign tax home. A tax home is defined as your prime place for service or work, no matter of your family members's house.

The Feie Calculator Diaries

An income tax obligation treaty in between the U.S. and an additional country can aid stop dual taxes. While the Foreign Earned Revenue Exclusion reduces taxable income, a treaty may give extra advantages for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare united state residents with over $10,000 in international monetary accounts.Qualification for FEIE relies on conference specific residency or physical presence tests. is a tax obligation expert on the Harness system and the creator of Chessis Tax obligation. He is a member of the National Organization of Enrolled Brokers, the Texas Culture of Enrolled Representatives, and you can find out more the Texas Culture of CPAs. He brings over a years of experience benefiting Big 4 companies, suggesting expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax expert on the Harness system and the creator of The Tax Guy. He has over thirty years of experience and now specializes in CFO services, equity settlement, copyright taxation, cannabis taxation and divorce associated tax/financial planning matters. He is a deportee based in Mexico - https://zenwriting.net/feiecalcu/uql44961c2.

The foreign earned income exclusions, sometimes referred to as the Sec. 911 exclusions, exclude tax on wages earned from working abroad. The exclusions comprise 2 parts - an income exclusion and a housing exclusion. The complying with FAQs talk about the advantage of the exclusions including when both spouses are deportees in a basic manner.

How Feie Calculator can Save You Time, Stress, and Money.

The tax obligation advantage leaves out the income from tax obligation at bottom tax obligation rates. Previously, the exclusions "came off the top" decreasing income topic to tax at the top tax rates.These exclusions do not spare the earnings from US taxation yet merely give a tax obligation decrease. Note that a bachelor working abroad for every one of 2025 who made regarding $145,000 without various other earnings will have gross income lowered to zero - efficiently the same solution as being "free of tax." The exemptions are calculated daily.

Report this wiki page